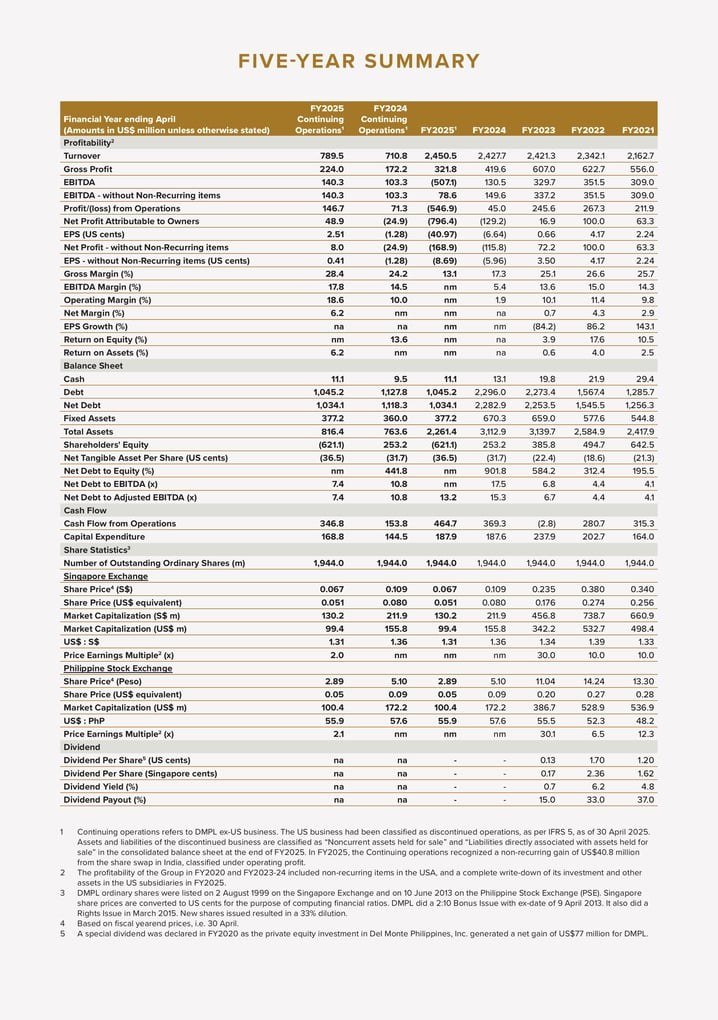

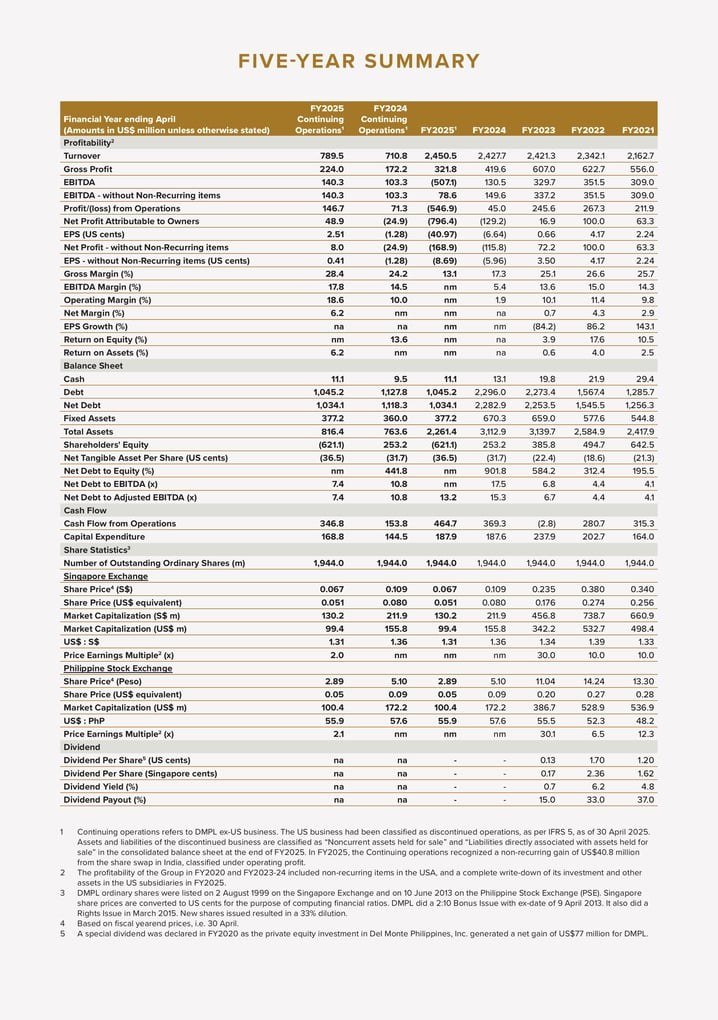

DMPL FY2024 (May 2023-April 2024) Highlights

- DMPL generated sales of US$2.4bn in FY2024, same as prior year as higher sales in the U.S. and higher exports of fresh pineapples were offset by lower exports of packaged products

- Del Monte Foods, Inc. (DMFI) delivered US$1.7bn sales or 72% of Group revenue, marginally higher by 1% due to pricing actions, incremental volume from foodservice and e-commerce, and higher broth, stock and bubble tea sales

- Market leadership maintained in nearly all core categories in the U.S. and Philippines, and for fresh pineapple in China

- However, higher inflationary and operational costs from higher inventory in the U.S. and lower pineapple supply and productivity in the Philippines led to a lower Group gross margin of 17.3% from 25.1%, and gross profit of US$419.6m, lower by 31%

- One-off costs of US$13.3m due to DMFI’s severance cost, IPO-related and professional fees; IPO had been deferred

- Without one-off costs, the Group generated:

- EBITDA of US$149.6m, down 56%

- Net loss of US$115.8m from a net profit of US$72.2m in the prior year

- Including one-off costs, the Group generated:

- EBITDA of US$130.5m, down 60%

- Net loss of US$129.2m from a net profit of US$16.9m in the prior year